China's ammonium chloride is primarily consumed across three sectors: agriculture, industry, and exports. The agricultural sector remains the dominant market, accounting for 60% of total demand. In the industrial sector, applications continue to expand, representing 30% of total demand. Benefiting from global trade agreements and policy support, China's ammonium chloride exports have grown steadily, with the export market contributing 10% of total demand.

In recent years, ammonium chloride production capacity has expanded steadily alongside the growth of combined soda ash and ammonia plants, reaching 20.55 million tons. However, plant utilization rates declined in the first half of this year to 82.46%, down 7.81% year-on-year, leading to reduced output. Production from January to June totaled 8.6391 million tons, a 5.05% decrease compared to the same period last year. This primarily resulted from depressed market prices squeezing profit margins, prompting some enterprises to reduce operating rates.

Agricultural Demand: Agriculture remains China's primary downstream market for ammonium chloride, with demand concentrated during spring plowing and autumn sowing seasons. March to May marked the peak demand period for spring fertilizer, but ample market supply shortened downstream procurement lead times and increased overall transaction concentration. Statistics indicate domestic downstream consumption of ammonium chloride in the first half of the year is estimated at 6.92 million tons, down 14.04% from 8.05 million tons in the same period last year.

Industrial Demand: Industrial demand for ammonium chloride remains relatively stable, primarily serving sectors like chemicals, pharmaceuticals, and electronics. Despite positive development trends across these industries, overall demand growth has been sluggish due to China's broader economic environment. For instance, in the chemical industry, some enterprises have curtailed ammonium chloride purchases amid raw material price volatility and market competition.

Export Demand: China's ammonium chloride exports are significantly influenced by policy factors. During the first half of the year, new commodity inspection policies temporarily reduced export volumes. Export volume is estimated at 900,000 tons, with total demand at 7.82 million tons—a 10.42% decrease compared to the same period last year. Although fluctuations in overseas demand have a relatively minor impact on the ammonium chloride market, changes in export volumes still exert some influence on the overall market supply-demand balance.

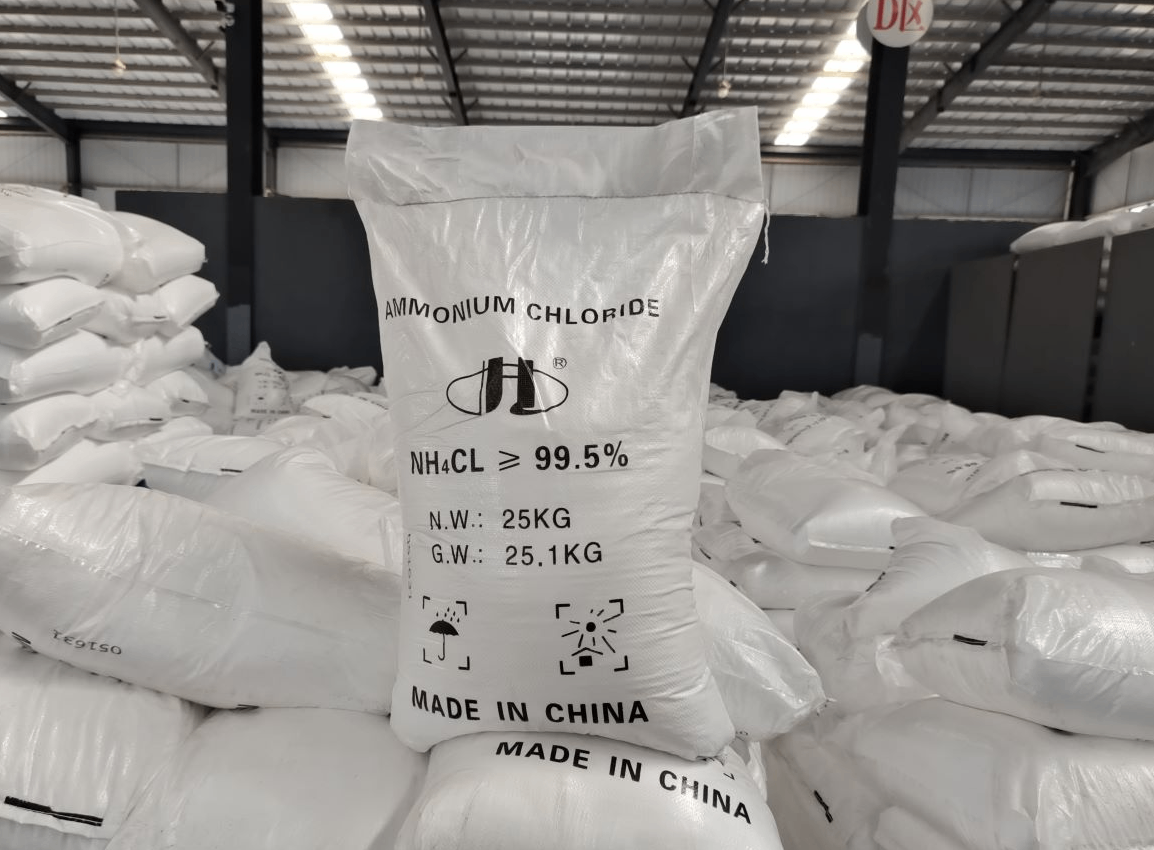

Ammonium Chloride Manufacturer

Ammonium Chloride Manufacturer